Liquidity Bootstrapping Auction (LBA)

Who can Participate in the LBA?

MKL Side Pool: Anyone who has earned preMKL through participation in trading seasons S0-S17 or the pre-TGE MKLP incentive program can participate in the MKL side pool of the LBA.

USDC Side Pool: Anyone with USDC who shares our vision of revolutionizing the perpetual trading experience with engaging, gamified elements are welcome to join.

How Merkle Trade’s LBA Works

The LBA is a dynamic price discovery process instrumental in establishing the fair market value of the MKL token. This auction benefits from organic price discovery, as actual bids from participants determine the price, reflecting genuine market demand.

Another significant advantage of the LBA is the deep liquidity it provides from the outset. Users commit capital to an Automated Market Making (AMM) pool, which aggregates liquidity as participation increases. This pooled liquidity directly contributes to the token’s market stability and enhances overall market efficiency.

Here’s a breakdown of how the LBA operates:

Period: August 29th — September 5th

Phase 1 (Day 1–5) — USDC can be supplied and withdrawn freely, and preMKL can be deposited (deposited preMKL cannot be withdrawn)

Phase 2 (Day 6) — USDC can be withdrawn up to 50%, with no deposits allowed in both Day 6 and Day 7

Phase 3 (Day 7) — Maximum withdrawal amount decreases to 0% linearly over 24 hours, with no deposits allowed

**All USDC mentioned here are zUSDC (LayerZero USDC)

Please note that deposited preMKL are unable to be withdrawn throughout the whole duration.

Crucially, the last two days of the LBA feature USDC withdrawal cap limits to prevent manipulation. Starting on Day 6, USDC withdrawals will be restricted to 50% of your deposit. On Day 7, this withdrawal limit will gradually decline from 50% to 0% over the course of the day. This gradual reduction enhances stability in price discovery as the LBA concludes.

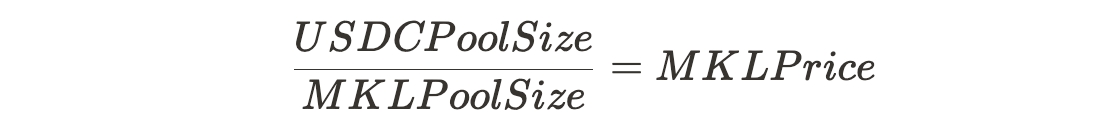

As the LBA concludes, the final ratio between USDC and preMKL will be the launching price of MKL.

Example 1: If $100,000 USDC and 100,000 MKL are deposited in the pool, the price of 1 MKL will be $1

Example 2: If $100,000 USDC and 200,000 MKL are deposited in the pool, the price of 1 MKL will be $0.5

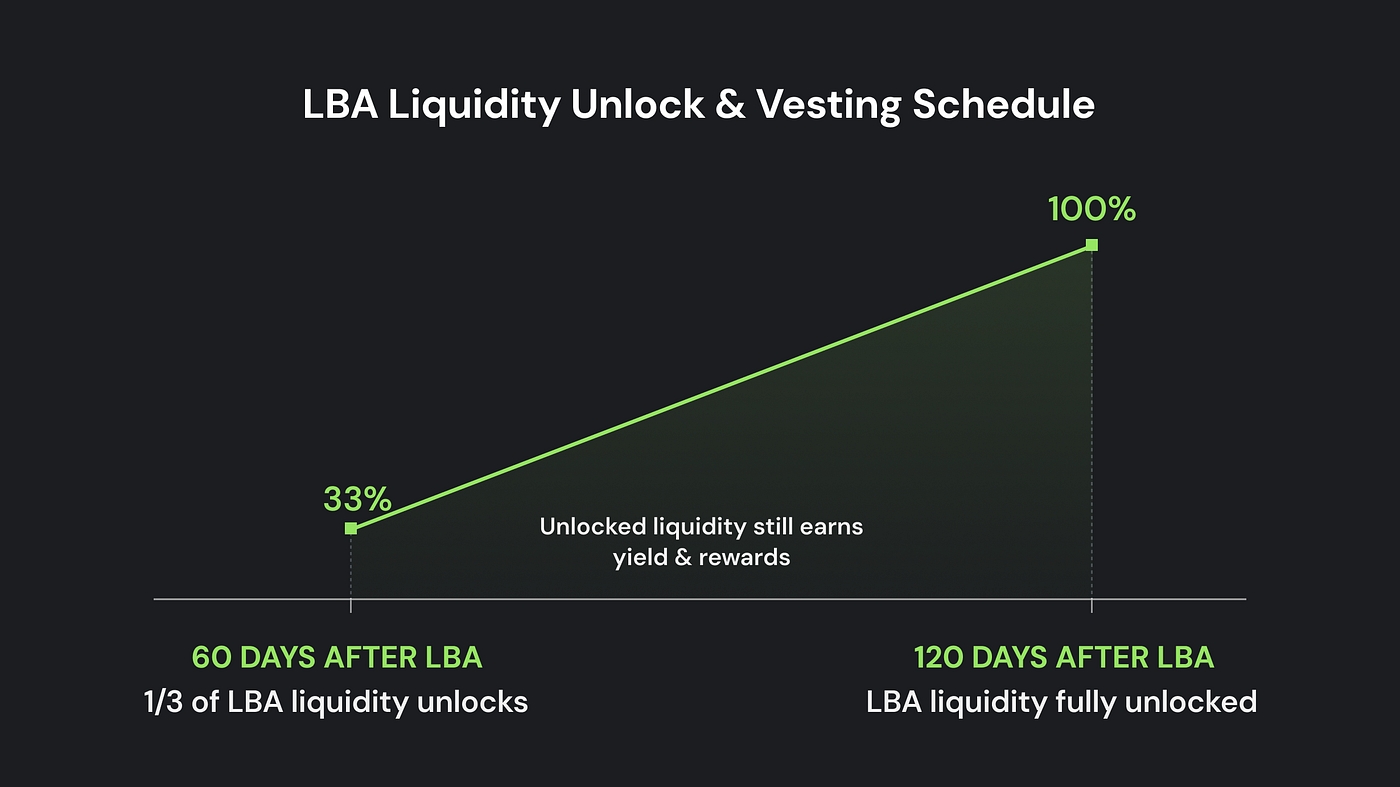

Post-LBA, the liquidity provided to the preMKL pool and/or USDC pool will be locked and vested over 120 days, with one-third unlocked after 60 days and the remainder vesting linearly over the next 60 days. Users who withdraw vested LP position will stop earning pool fees and MKL incentives on the withdrawn portions. However, any LP position that remains vested will continue to accrue dual rewards.

Benefits of the Merkle LBA

There are two core benefits of the Merkle LBA.

Fair MKL Price: Users interested in gaining exposure to MKL can purchase the token at a fair market price during the LBA, with the virtual price gradually adjusting over a 7-day period.

Dual Rewards: Users providing liquidity to one or both of the pools (MKL & USDC) during the auction will earn additional incentives, composed of:

Pool Fees: LBA participants earn rewards from trading fees as liquidity providers. The Automated Market Maker (AMM) Pool created during the LBA will serve as the primary source of liquidity for all MKL trades. Liquidity providers (LPs) will receive a portion of the trading fees generated by this pool throughout their capital commitment. Rewards are distributed to LPs of both pools, ensuring that everyone participating in the auction earns dual rewards.

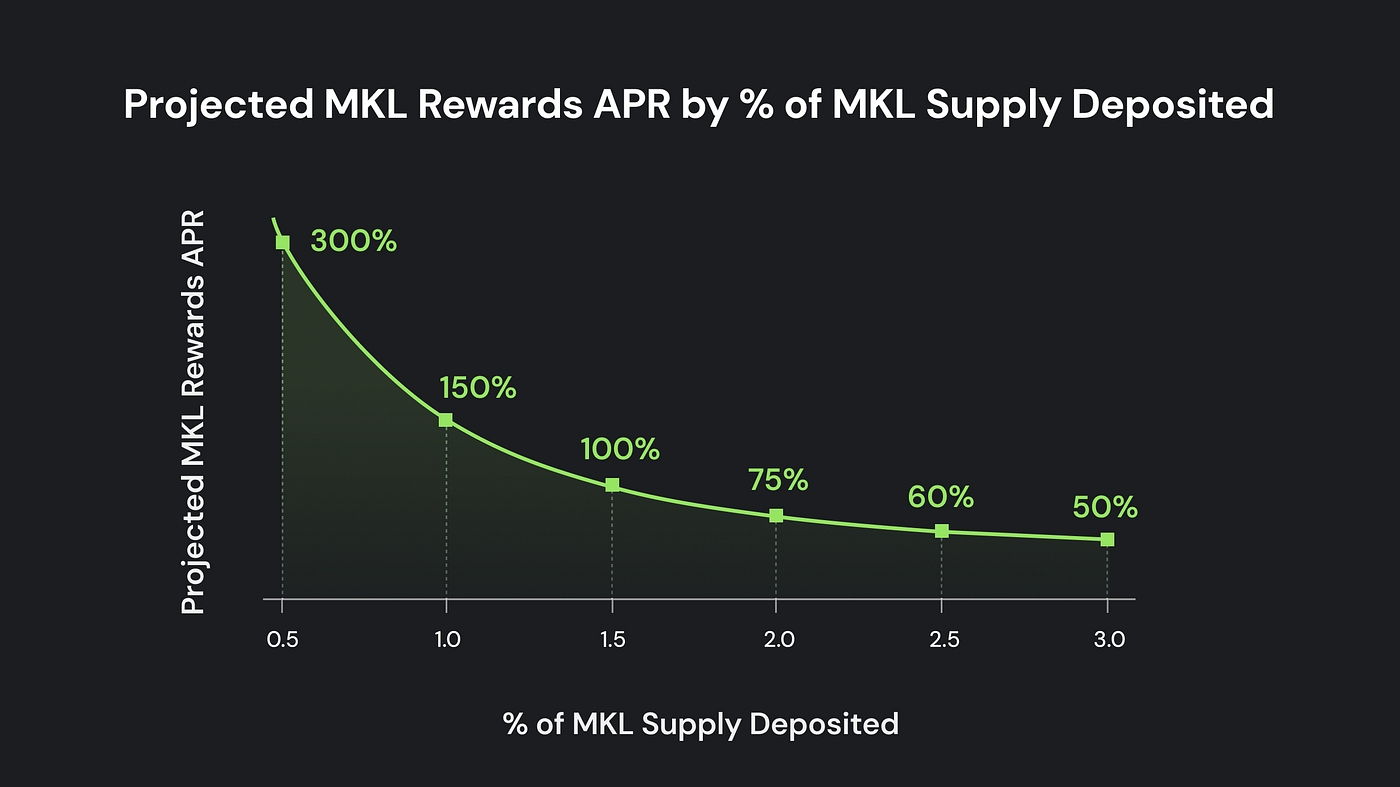

Dedicated LP Incentives for LBA participants: To incentivize long-term commitment to the Merkle Trade ecosystem, 1% of the total MKL supply will be allocated to the LBA pool. Below are rough APR projections based on the capital committed.

How to Participate in the LBA?

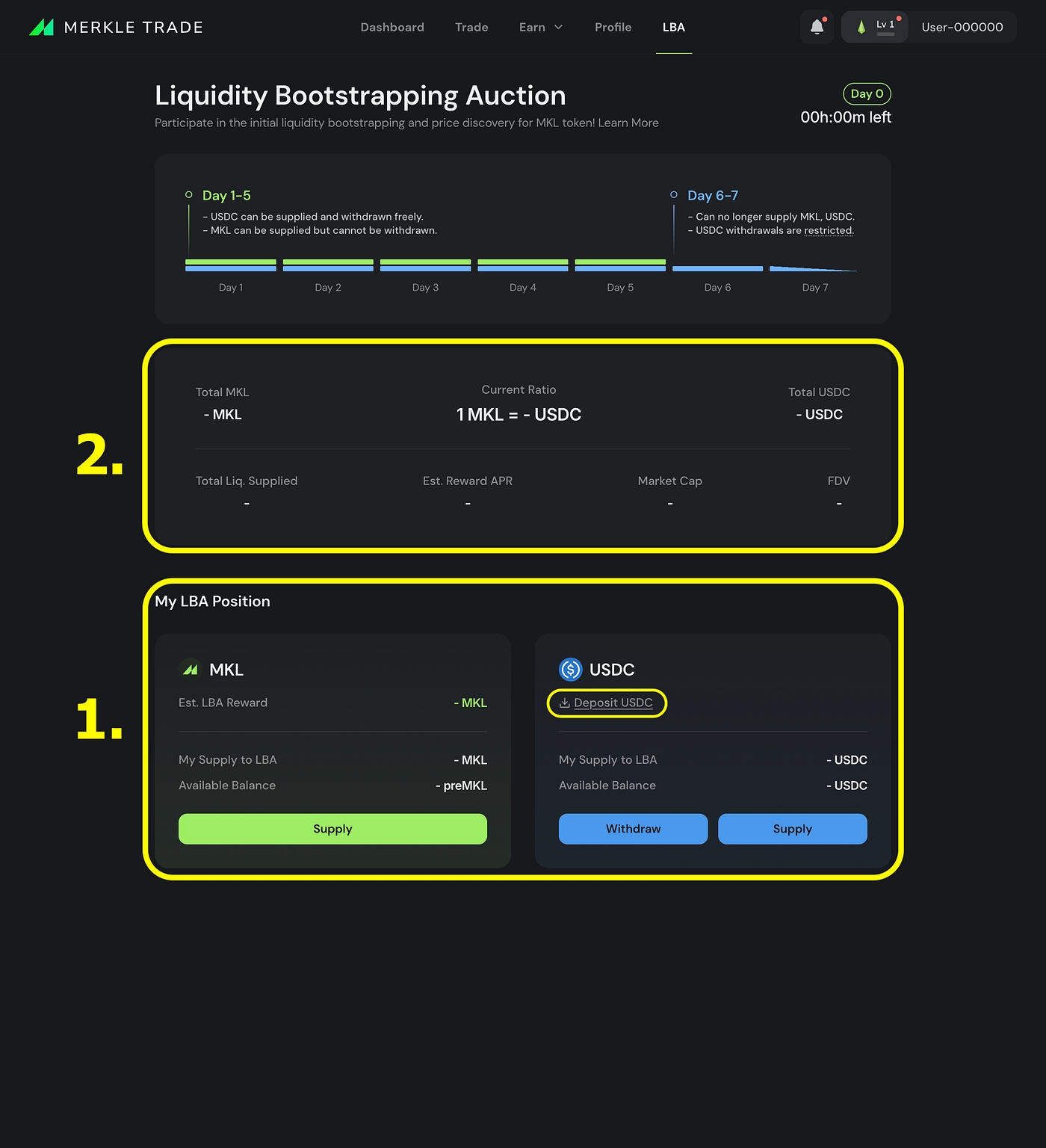

Begin by navigating to the LBA page within the Merkle Trade dApp.

1. At the bottom of the page, you’ll find your available preMKL and USDC balances. Keep the following in mind:

Viewing preMKL Balance: If you’ve participated in preMKL incentive programs, your preMKL balance will be displayed automatically.

Depositing More USDC: If you wish to add more USDC to your account, simply click on the ‘Deposit USDC’ button highlighted above.

For Aptos 1CT users: You can deposit into the LBA directly from your Aptos wallet. If you hold balances in your 1CT account, withdraw your USDC to your wallet to participate. This step is not necessary for EVM accounts.

2. In this section, you can track all relevant information about the LBA’s progression, including the deposited USDC-MKL ratio, the resulting reward APR & FDV, and other key metrics.

Last updated